If real estate investment has piqued your interest, you’re probably wondering how to become a real estate millionaire. The nice thing about real estate investment is that almost anybody can get started and, with enough perseverance, generate wealth without having to wait a lifetime for their money to grow.

It is commonly known that real estate is where 90% of millionaires make their money. However, is this still true? Is it still a smart idea to invest in real estate? The answer is a loud yes. But you must remember that just because you purchase real estate does not guarantee you’re going to make money.

Real Estate’s 4 Wealth Generators

Each of these attributes can help you produce more money on its own, but when combined, they will make you wealthy.

- Cash Flow

- Appreciation

- The Loan Pay-Down

- Tax Benefits

As I previously stated, each of these money producers has the potential to be quite strong. However, due to the synergy between the four, combining them can make you extremely wealthy. Real estate isn’t the only method to grow rich today, but because of the four wealth generators of real estate, it’s a straightforward one to grasp.

How to Become a Millionaire in Real Estate

There’s one thing every new real estate investor wants to know, and that’s how to build a real estate empire worth millions. Luckily for you, we want to help you.

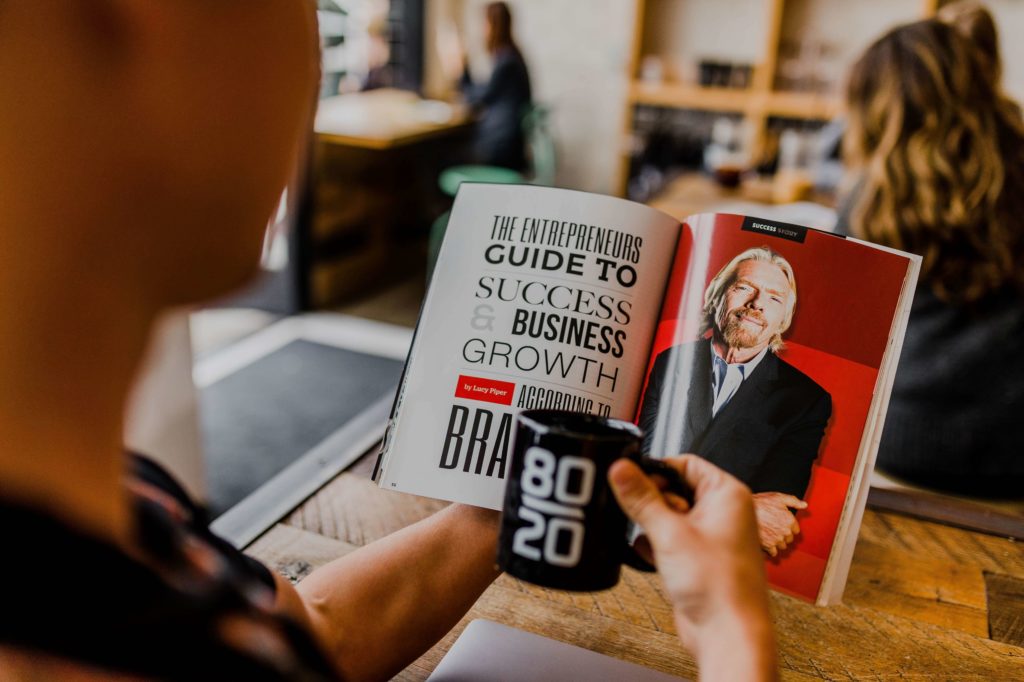

1. Find out more about real estate investment.

Before you go into real estate investing, you should educate yourself on the many sorts of investments and tactics available. Learn about the responsibilities of property management, how taxes operate, and how to obtain financing.

Many publications and resources exist to assist you in learning how to invest in real estate. Getting advice from other investors is also a good idea. Just make sure you’re obtaining it from a reputable source. It’s much better if you can locate a mentor.

2. Make a strategy to become a real estate billionaire by setting goals and making a plan.

It’s time to define your goals and develop a strategy now that you know how different real estate investment tactics function. You’ll never know what you’re working toward unless you have a particular goal in mind and a strategy for achieving it.

You must go beyond merely stating that you want to acquire real estate and become a billionaire when setting your real estate goals.

Your objectives should be broken down into milestones as well. Set modest goals to help you get closer to your larger objectives. Decide what you need to accomplish each day to get closer to your goal.

You must create a real estate investing strategy in the same way that a new firm must create a business plan. The plan that will work best for you is determined by your existing circumstances. If you’re starting off with little money, you’ll need to take a different strategy than if you already have enough money to acquire an apartment complex.

3. Stop wasting time and get started today.

The majority of real estate investors fail before they ever begin, simply because they never begin. Commit to taking the first step now that you have your strategy in place. Begin looking for bargains and seeing homes.

It’s easy to get caught up in the planning stage and become preoccupied with little details that won’t get you any closer to closing your first transaction. Every day, ask yourself, “What am I doing today that is bringing me closer to being a real estate millionaire?”

4. Create a cash flow.

After paying costs and debt servicing, your properties should generate positive cash flow. As a result, the rental revenue will continue to pay down the mortgage and create equity while also providing monthly income. Your income rises in tandem with the size of your portfolio. You’ll grow closer to your objective of becoming a real estate billionaire each month.

Unless you induce appreciation by boosting a property’s cash flow, appreciation might be unexpected. The only way to ensure that you will benefit from your real estate purchase is to generate monthly revenue.

5. Continue to grow.

Once you’ve purchased one house, the cash flow and equity make purchasing a second much easier. Purchasing the second home makes purchasing the third much easy, and so on. As you purchase more property, this tendency will continue. The greater your real estate portfolio, the more protected you will be from losses on certain transactions.

Conclusion

It’s not impossible to become a real estate millionaire. It’s not an easy aim to attain, either. Expect it to take time, but know that you have the ability to make it happen. Gaining the necessary information, establishing a plan, and sticking to your plan to become a billionaire in real estate are all essential components of real estate investment success.